capital gains tax changes 2021

Thus the current capital gains tax is 6 for both. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024.

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Capital Gains Tax CGT is imposed at the rate of 20 on.

. However the Biden administration has proposed changes to how the capital gains tax is. President Donald Trump s main proposed change to the capital gains tax was to repeal the 38 Medicare surtax that took effect in 2013. Before you phone check whether you need other publications.

Long-term capital gains tax rate. Metropole Wealth Advisory can review your structure make recommendations and then implement any required changes. Download a PDF of the Capital gains tax CGT schedule 2021 PDF 375KB This link will download a file.

The IRS considers assets held for longer than one year to be long-term investments. A capital gains tax CGT. If your income falls in the 40400441450 range your capital gains tax rate as a single person is 15 in 2021.

Long-term capital gains apply to assets that you held. The long-term capital gains tax rates are 0 15 and 20 depending on your income tax bracket. Tax policy was a part of the 2016 presidential campaign as candidates proposed changes to the tax code that affect the capital gains tax.

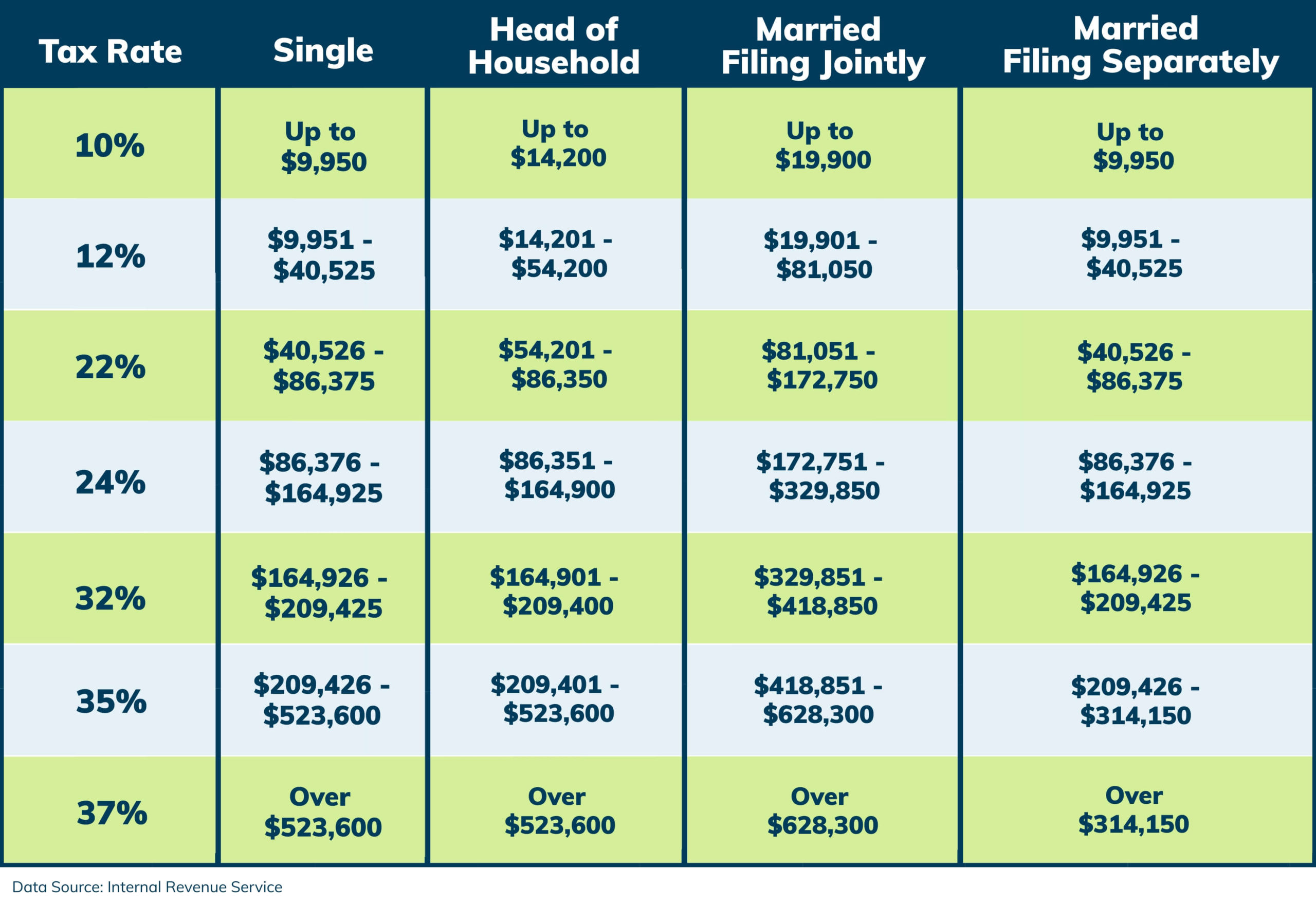

Terms and conditions may vary and are subject to change without. In 2021 and 2022 the capital gains tax rates are. They are subject to ordinary income tax rates meaning theyre taxed federally at either 10 12 22 24 32 35 or 37.

It was introduced in 2015 with 12 and reduced to 10 in 2021. Capital gains tax CGT is the tax you pay on profits from selling assets such as property. The income range rises slightly to the 41675459750 range for 2022.

These rates are typically much lower than the ordinary income tax rate. This will save you time and help us. Short-term capital gain tax rates.

The Capital gains tax CGT schedule 2021 NAT 3423-62021 is available in Portable Document Format PDF. Short-term capital gains are gains apply to assets or property you held for one year or less. Long-term capital gains tax and short-term capital gains tax capital gains tax triggers how each is calculated how to cut your tax bill.

The good news is that the tax code allows you to exclude some or all of such a gain from capital gains tax as long as you meet three conditions. You need to quote the full title Personal investors guide to capital gains tax 2021 to use this service. Of the income tax rate which is 12 for individuals and companies after the changes to the tax code from 1 October 2018.

Phone our Publications Distribution Service on 1300 720 092.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

What You Need To Know About Capital Gains Tax

What You Need To Know About Capital Gains Tax

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What S In Biden S Capital Gains Tax Plan Smartasset

2021 Tax Changes And Tax Brackets

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Understanding Capital Gains Tax On Real Estate Investment Property

What You Need To Know About Capital Gains Tax

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Capital Gains Tax What It Is How It Works Seeking Alpha

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)